Are you keeping up with the wave of Digital Transformation? Have you given a thought about what stance you need to adopt against evolving Customer Expectations, Demographics, Technology Advancements, and Economic Shifts, especially when you are a part of the Banking, Finance & Insurance Industry? One of the biggest challenges is, tackling piles of documents/paperwork to obtain the required information or data, which often leads to a decrease in operational efficiency since you need to spend intensively on the workforce. To keep up in today’s Digital Era, we need to let go of some manual, tedious processes (like Data Entry) and adapt faster, innovative solutions that help boost efficiency. Let’s dive deep and understand Why Data Digitization is Unavoidable for Businesses?

According to market research firm IDC, companies lose 20 to 30 percent in revenue every year due to inefficiencies. Document Validation is one of the critical problems that could lead to inefficiency.

Is OCR the solution to accelerate the process of Data Digitization?

The answer is YES, Optical Character Recognition (OCR) plays a vital role in accelerating the efficiency of collecting data from scanned images of documents. With OCR scanning, a varied range of paper-based documents, in different languages and formats can be processed into machine-readable text, that not only simplifies the stash of papers but also makes previously inaccessible details available to everyone within a few clicks and a fraction of seconds.

So, what is OCR & what does it do?

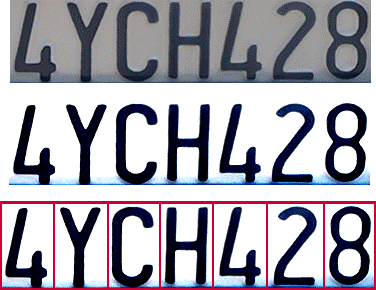

OCR technology is used in data digitization to convert scanned images containing text into machine-readable text so that the data can be searched, indexed and retrieved. It is a widely popular technology that has found applications across disparate industry verticals. Imagine any kind of serial number (e.g. license number plate) or code which is a combination of numbers and letters that you need digitized. Using OCR technology, you can transform those serial numbers (code) into a digital output. To put it simply, images get processed using an OCR Engine to yield the same output in characters that can be recognized and be available for further analysis.

Let’s take a look at different techniques used in OCR.

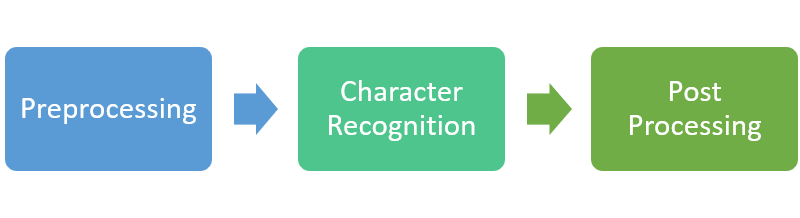

Preprocessing– The very first step that OCR software does is preprocessing, to improve the chances of recognizing the text. The key objective here is to improve image data and that’s the reason unwanted distortions are suppressed, and specific image features are enhanced, both required for further processing.

Character Recognition– It’s very important to understand what feature extraction is. In the feature extraction, the software scans commonly – occurring symbols and then breaks them down into their basic shapes, picking out the letters it has high confidence about. Conventionally, HOG features algorithm was used to recognize characters. Now, advanced Neural Net based algorithms are used for character recognition.

Post Processing- This is yet another error correction technique employed in OCR software to ensure high accuracy. Ostensibly, the accuracy can be further improved if the output is restricted by a lexicon. In that manner, the algorithm falls back to a list of words that are allowed to occur in the scanned document.

Current Challenges with OCR

Data collection or capture from bills of landing/ invoices/ tax receipts/ cheques/ orders- is what OCR does with the entwined combination of image pre-processing, identifying characters and putting together words, blocks, and sentences. But when it comes to gaining context or extracting meaning from many forms of digital assets listed above, basic OCR in itself does not suffice.

To overcome such challenges of data digitization, smart OCR software comes into the picture. Such software helps in extracting valuable information from invoices, records, bills, and paper documents and helping with further analysis & intelligence as per custom requirements.

Customized OCR applications work in tandem with intelligent algorithms to look for specific entries such as dates, purchase order numbers, reference IDs across documents. Such trained systems produce greater than 90% accurate results and are thus, able to analyze thousands of documents in a fraction of minutes.

An evolution in the OCR Lineage is ICR or Intelligent Character Recognition. This comes into use while digitizing Handwritten Forms and Documents. ICR works mainly on an Artificial Intelligence System called Neural Networks, where the NN Layer integrated with OCR, continuously updates its handwritten pattern database (or intelligence) to yield increasingly accurate results over time.

Understanding Intelligent Character Recognition

Intelligent Character Recognition (ICR), known as a smarter application of OCR learns different fonts and styles of handwriting. For example, the ICR software recognizes isolated characters by distinguishing the individual shapes and sizes within each character classifier, identifying extracted features such as curves, loops and lines. It then organizes them in a logical and actionable order according to the user’s information management specifications.

Combining AI & ML to make OCR intelligent

OCR technology has become widely popular. In fact, smartphones are coming with inbuilt OCR features that can recognize text from the images. Such mobile OCR software are specialized to particular business use cases for data digitization. For example, credit card scanning, voucher scanning, or document scanning. The list goes on and on.

Tesseract OCR is a kind of open-source OCR engine that is widely popular amongst the developers. There are other techniques for OCR such as HOG+SVM (a machine learning algorithm), Neural Net based, End-to-End Deep Learning-based Model (CNN), which are enabling OCR systems to interpret meaning from digital documents as humans do.

Now, let’s dig deeper to know how OCR is helpful in solving real-world problems

When you count the applications of using OCR, there is a myriad of possibilities across industries, enabling huge savings on man-power & time costs.

Identification Process – In the Photo IDs, there exists a machine-readable zone (MRZ) which can be scanned. By using OCR, the identification process can be sped up. Also, it helps in registering the people at different checkpoints. Thus, it is useful for immigration officers or other security personnel to ensure the utmost security.

Payment Processes– The International Bank Account Number (IBAN), which is used to identify bank account across borders has different length and comprised of numbers as well as letters. To enable border transactions, banking apps can integrate OCR software. In that way, their customers can scan their IBAN cards without typing in.

Self-check-in at hotels– It is very frustrating to stand up in check-in queue. With mobile self-check-in OCR, guests can complete all the check-in formalities within 5 minutes. This process not only reduces the length of guest check-in time but also lessens the workload of hotel staff that type-in customer details into their hotel management system and pass this info onto local authorities.

Counterfeit currency checking– Fake currency cheques/notes can be tracked using a specific OCR application. This technology works on capturing & analyzing the currency serial numbers circulating in a banking system. The system maintains transaction records for creating an audit trail.

Document Digitization: All kinds of KYC documentation, loan applications, insurance certificates, withdrawal/ deposit slips, patient application forms etc. can be digitized using OCR software. The digitization process reduces the time and cost involved in manual data entry and helps in maintaining digital repositories for easy accessibility.

Visitor access management: To ensure security at the entry point of any facility, an OCR software that reads license plate number of the vehicles can be of great help. KritiKal’s License Plate Recognition (KLiPR) system detects the presence of a vehicle, locates the number plate on the detected vehicle, segments the character from the number plate and does an Optical Character Recognition (OCR) on the segmented characters to generate the Vehicle Registration Number as text along with the Number Plate Image, Timestamp and Vehicle Image.

Traffic sign and scene recognition: Automatic detection and sign recognition play a vital role in automated driver assistance system, which contributes to the safety of drivers, pedestrians, and vehicles. KritiKal’s smart OCR system crafted by using various image segmentation techniques reads traffic and direction messages to ensure safer and efficient driving.

Final Thoughts

Legacy infrastructure lacks in the scalability needed to maintain low-costs and high data quality when volume of documents escalates to millions & trillions.

Did you know? The root cause of data inaccuracy is human error, which often impairs data integrity & compromises analytics.

A research from Experian Data quality has shown that 61 percent of companies reported that human error was a problem for their company. Also, the report revealed that 83 percent of companies believe that inaccurate and inept customer/prospect data can affect adversely on revenue.

Automation is a crucial aspect- the key to triumph is in its execution.

The automation of manual data entry tasks using Smart OCR systems has the potential to drive business growth & increase operational efficiencies. If you’re grappling with challenges to extract data from legacy systems, then staying the same is not an option. The right data capture approach can help companies to create significant value by reducing back-office costs.